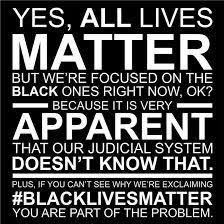

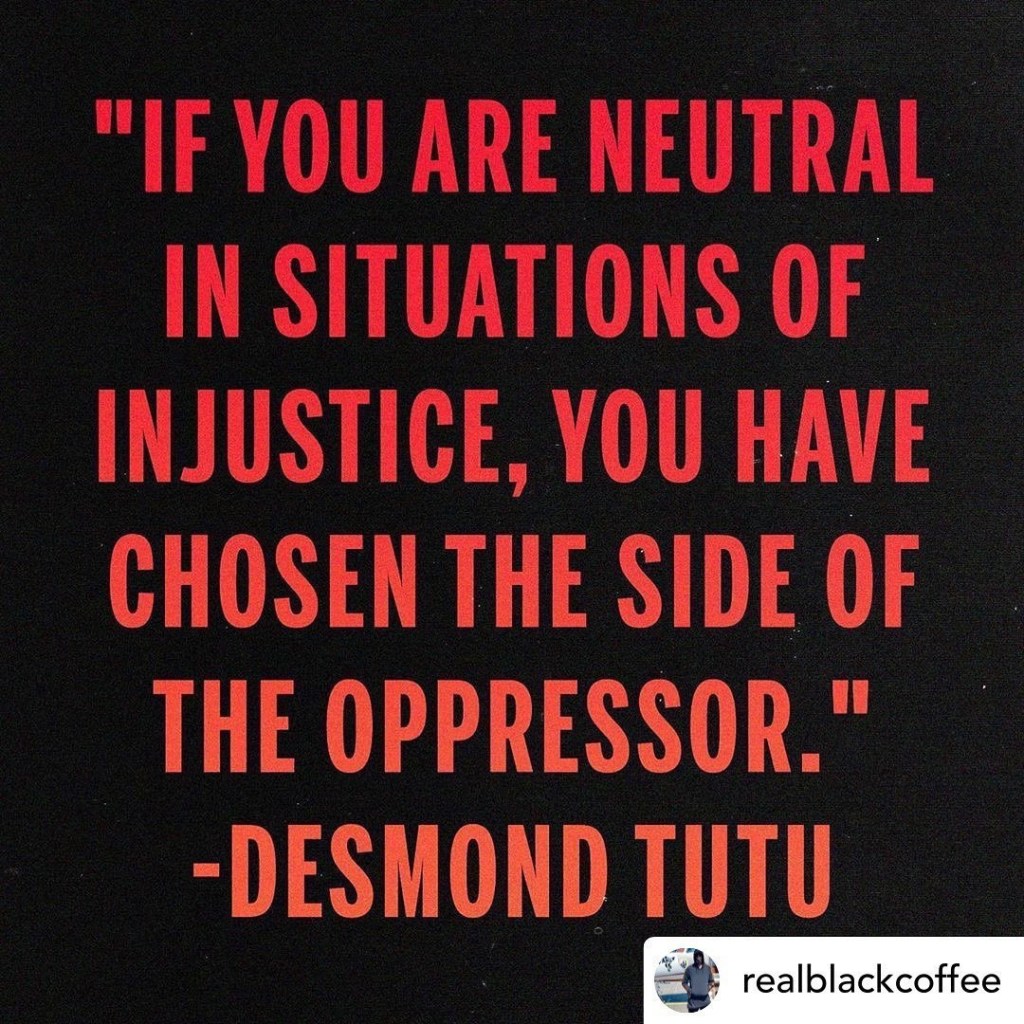

When a community is grieving in war, is demanding their rights, is pleading for peace, is shut out from equal justice – we need to take a step back from our daily grind, pay attention and listen. Because if you don’t listen to them, then you cannot stand with them. & if you do not stand with them, you are no different from their oppressors.

Some mornings I wake up afraid to look at the latest daily headlines because I’m such a sensitive person. I put it off until I no longer can delay the inevitable. Then I take a deep breath and brace myself.

Lately, it’s been harder than usual. But even before I peruse the breaking news, I know what to expect. Rarely does it fail to deliver. Read all about it: Unarmed black man killed by a white policeman. Black man shot to death by white woman in his own home after she mistakes him for an intruder. White woman calls cops to report “an African-American man” who politely asked her to leash her dog in Central Park.

It’s infuriating, predictable and honestly, it’s getting old. And some white people wonder why black people are so angry. Of course, we’re angry. I don’t condone rioting but it’s not like protesters just happen to wake up on the wrong side of the bed and, unprovoked, decide, “Let’s start burning and looting today.”

IS THERE NO PLACE ON EARTH WHERE IT’S OKAY TO BE BLACK?

Last week I watched a four-part Henry Louis Gates Jr. documentary from 2011 called “Black in Latin America” and felt an old familiar feeling, one that first crushed me when I watched the 1977 TV miniseries Roots: I was horrified and furious.

I can’t remember the last time I spent so many hours giving YouTube my undivided attention. Usually, I’m doing something else as I watch, but I couldn’t pull my eyes away from the stories of enslavement, disenfranchisement, genocide, perseverance, pride, determination, and hope.

This time, though, my anger felt different. It was mingled with a certain despair and resignation. I’m starting to feel terrified and unsafe in my own skin, right here, in my own living room, in my own home. Is there literally no place on earth where it’s okay and safe to be a black person?

“It’s not just driving or running. Simply being black can get you killed.”

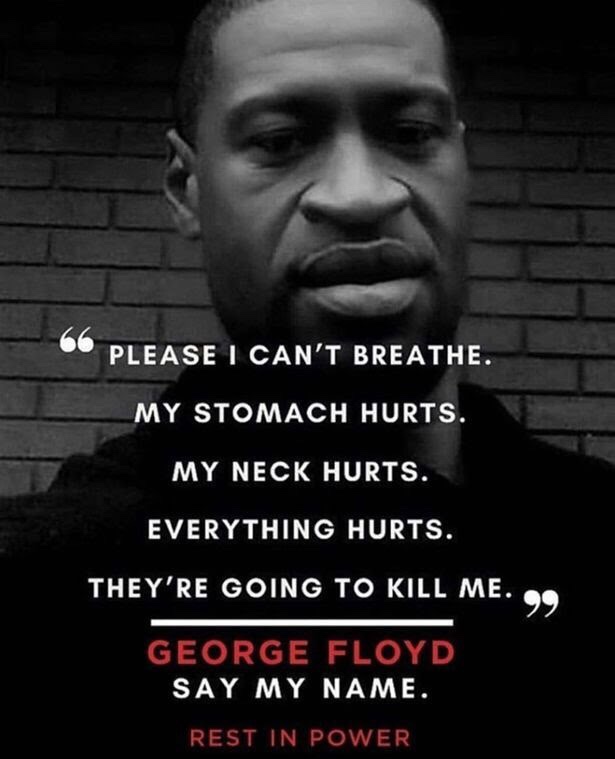

The list of unofficial criminal offenses that Black people can be killed for continues to grow. We can’t drive while Black (Philando Castile), jog while Black (Ahmaud Arbery), or sleep while Black (Breonna Taylor). And now, with George Floyd, we can officially add breathing while Black to that lineup of senseless violations.

In the wake of the heinous murder of George Floyd by police officers, people are angry, I AM ANGRY, and justifiably so. And if you still don’t understand why we are angry, let me do you a solid and break it down for you:

- We are angry because police brutality continues to claim the lives of black people

- We are angry because a city has to be burned down so people can be be given a shot at justice

- We are angry because this isn’t anything new.

- We are angry because a peaceful protest was met with rubber bullets and tear gas when all people are doing is demanding justice, the very same justice the law tells us we deserve.

- We are angry because after all of that, after watching a man being murdered on screen, we are being told that his death is going to be tried as an accident.

IS THIS REALLY WHAT WE CALL JUSTICE?

“When is it going to end? When is it going to be ok to be black? When do they plan to stop killing us?”

The truth is that murder’s like George Floyd’s will never become a relic of the past until the whole world banishes slavery.

Also, stop trying to control how people react to racism!!

Another thing that gets my blood boiling, how people are trying to control how we react to racism. How Black people react to racism isn’t anyone else’s business. No one gets to tell us how to respond until they’ve had a security guard follow them around as soon as they step foot into a store because they’re the only Black person there. No one gets to tell us how to react until the sound of sirens triggers their fight or flight instinct despite their not doing anything wrong. Until they truly understand the despair that leaks into our veins every time another Black man, woman, or child is gunned down by the police.

NO ONE, AND I MEAN NO ONE, GETS TO TELL US HOW TO REACT TO RACISM UNLESS THEY’VE WALKED A MILE IN OUR SKIN!

The world we live in is full of injustice. From bullies on the playground to dictators on the world stage, people are committing acts of cruelty every day. Sometimes all it takes is a small action or word of support to save the victim, and other times even armies cannot stop a tormenter in action. But either way, bystanders play a crucial role in each situation. Remember what I said at the beginning of the article, “if you don’t stand with us, you stand with our oppressors.”

Right here, right now, I want you to decide: are you with us or are you with our oppressors?